total property tax in frisco tx

For Sale - 7954 Glastonbury Dr Frisco TX - 570000. 181 of home value.

Tarrant County Tx Property Tax Calculator Smartasset

Assumes a new 25000 Honda Accord and Sales Tax is amortized over 6 years.

. Exemptions from property tax require applications in most circumstances. Here is some information about the current Frisco property taxes. Taxing units are required by the state to offer certain mandatory exemptions and have the option to decide locally on whether or not to offer others local option.

Address Phone Number and Hours for Denton County Tax Collector - Frisco Office a Treasurer Tax Collector Office at Farm to Market Road 423 Frisco TX. At the citys proposed rate the average Frisco homeowner will pay 1845 in city property taxes on a home valued at 413028 up about 2 percent from last year. City of Frisco Total.

Taxpayers in the city of Frisco will again see higher property tax bills on average even though the city is not raising the tax rate. The year-over-year appreciation of existing property including residential commercial land improvements and more was 16 in Collin County and 39 in Denton County. The combined tax rate is a combination of an MO tax rate of 09972 and an IS tax rate of 027.

For Sale - 13944 Matthew Ln Frisco TX - 715000. Collin County Tax Assessor Collector Office 6101 Frisco Square Boulevard 2nd Floor Frisco TX 75034 Phone. Denton County Tax Collector - Frisco Office Contact Information.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Frisco as well as every other in-county public taxing unit can at this point compute required tax rates since market value totals have been recorded. 2022 Cost of Living Calculator for Taxes.

Name Denton County Tax Collector - Frisco Office Address 5533 Farm to Market Road 423 Frisco Texas 75034 Phone 940-349-3510. Interest Sinking Fund. Frisco Tax Rates for Collin County.

Overall the total taxable value of property within Frisco ISD rose 67 from 2020 to 2021 to 4658 billion. Thus its mainly all about budgeting first setting an annual expenditure total. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth.

City of Frisco Base Property Tax Rate. Tax amount varies by county. 2022 Cost of Living Calculator for Taxes.

View details map and photos of this single family property with 5 bedrooms and 4 total baths. Collin County Tax Assessor-Collector Frisco Office 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034. One important factor in home affordability in Frisco Texas is your Frisco Texas property taxes.

Collin County Tax Assessor-Collector Frisco Office. When added together the property tax load all owners support is established. A total exemption excludes the entire propertys appraised value from taxation.

Total exemptions may be granted for public properties or those owned by qualifying organizations such as churches schools or charitable organizations. Purefoy Municipal Center Frisco City Hall 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034 Map. Frisco Texas and Austin Texas.

Monday - Friday 8 am. The tax rates are stated at a rate per 100 of assessed value. Assumes a new 25000 Honda Accord and Sales Tax is amortized over 6 years.

All Frisco ISD taxes are collected by the Collin County Tax Office. Total property tax in frisco tx Thursday June 23 2022 Edit The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. The 2021 adopted tax rate for Frisco ISD is 12672.

Property taxes are local taxes. Which is billing for the City of Frisco taxes and Frisco ISD taxes. View details map and photos of this single family property with 3 bedrooms and 3 total baths.

Property taxes in Texas are ad valorem meaning they are based on the 100 assessed value of the property. Texas has one of the highest average property tax rates in the country with only thirteen states levying. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

Plano Texas and Frisco Texas.

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

10614 Stargazer Dr Frisco Tx 75033 Realtor Com

Why Are Texas Property Taxes So High Home Tax Solutions

Buying Or Selling Irving Tx Real Estate The Timing Couldn T Be Bette Dallas Real Estate Real Estate Real Estate Marketing

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Auburn Plan By Taylor Morrison In South Oak In Oak Point Tx

What Is The Property Tax Rate In Coppell Texas

What Is The Property Tax Rate In Frisco Texas

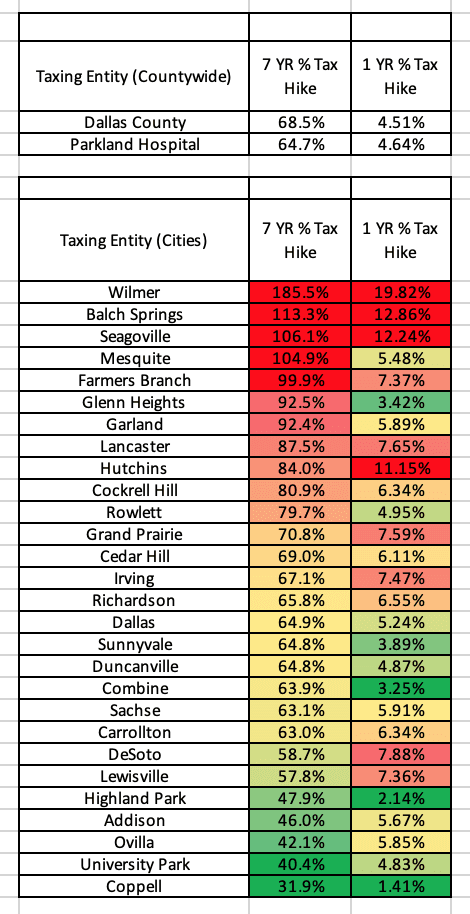

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Beautiful Corner Lot Property In The Sought After Frisco Isd This Home Boasts 4 Beds 3 Baths And 2 Car Garage The Ki New Home Construction Home Buying Home

What Is The Property Tax Rate In Frisco Texas

The Most Expensive Home For Sale In Texas

7770 Oakcrest Dr Frisco Tx 75034 Realtor Com

Budget And Tax Facts City Of Lewisville Tx

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard